Vakis Rigas

July 30, 2024

Even founders taught us that when you have a track record, you are a less risky investment. Your alma mater and your experience are all factors that come into play, mainly because that’s where you build your network. The people you know pave the path for what you can achieve, but this isn’t always true.

In toddle’s case, it was quite the opposite. While experienced, none of toddle’s founders have big-name backgrounds and are both first-time founders.

Andreas and Kasper wanted to improve their workflow, so they built a product that would do just that. Rather than raising funds pre-product, they built a toddle next to their day jobs. Their passion project became their obsession, and they built a product that was so powerful that it spoke for itself.

The goal was to change how software is built. Andreas, a coder of 20+ years, didn’t particularly like coding. He became an engineer to solve complex problems, not to type in machine-readable characters.

Coding has become an art form, but it is still an abstraction that translates to 0’s and 1’s.

Toddle makes that apparent, making it easier for us to show long-term change to a large industry. Why would anyone ever build beautiful web apps in a text editor when they can build them in a visual tool without abstractions?

Investments are technically bets. Every investment is a hope for a better future and a belief that this vision will deliver an outsized return. Investors do everything they can to reduce risk; one factor is a track record, and another is product.

To close any investment, you must show investors what you have seen that no one else has. That can be your ability to build new markets, disrupt existing markets, or take advantage of a peculiar situation.

It’s not enough to slap AI on your pitch deck. To raise funds, you must have a strong vision and team and show that you can execute at a different pace than incumbents. These factors all help investors understand how and why your team can make a change.

You are judged on your team’s ability to execute, the viability of your product, and the market potential. All these must put you in the green, and to make it even harder, every investor measures them differently. Your ability to tell a story that compels your audience is crucial if you hope to convince anyone to take a bet on you.

We just raised a $4.3M seed round without AI or other buzzwords in our pitch deck. We are sharing it in hopes you might find some use for it.

Click "f" for full-screen.

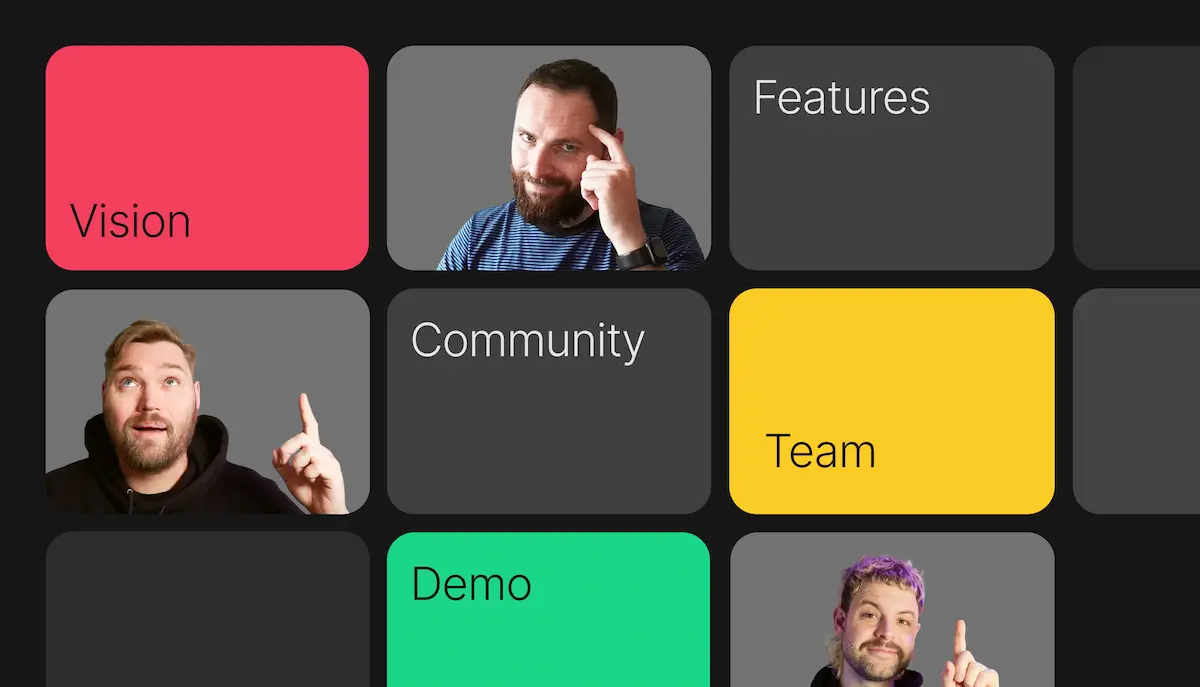

Getting a meeting with investors isn't easy, and sometimes, you need to make a small gimmick to get the attention. We built our pitch deck in toddle. Why not get investors to try the product before they invest?

Despite the gimmick, we were fortunate enough to present our story to the right investors at the opportune moment, backed by an exceptional team and a superior product. We spoke to more than 50 investors, and even with open doors, we still found ourselves in a difficult situation. We didn't need to raise, and if we did, we wanted to make sure that we found a partner who shared our vision of the future.

It's important to note that once you take money, you enter a lifelong partnership (no pressure 😅). They provide guidance, pressure, and support, for better or worse, and you need people around you who share your vision to get where you need to go.

Numerous factors influence investment decisions; don't let rejections discourage you. Use them to refine your pitch, not alter your vision. Build resilience that will fortify you against downturns and make you a force to be reckoned with. If you don’t, the path will be long, lonely, and most likely unsurmountable.

.jpeg/public)